Pension provision for self-employed persons

Self-employed persons have more leeway with regard to their pension provision than employees. They have to organize their retirement provision themselves and can choose whether they want to provide for their old age with or without a pension fund.

Those who become self-employed are often faced with the question: sole proprietorship or corporation? The legal form of the company has a major influence on the pension plan and on the use of the vested benefits capital.

If you set up a limited company or a limited liability company, you are considered an employee of your company for insurance purposes and must therefore transfer your pension fund assets to the new pension fund. He cannot use it as start-up capital for the new company either.

Persons who are owners of sole proprietorships, general partnerships or limited partnerships are considered self-employed. They are free to decide what to do with any pension fund assets: park them in a vested benefits account, take out a vested benefits policy, set up a vested benefits custody account or withdraw them early and invest them in their own company. A withdrawal of the

However, it is only possible to withdraw the credit balance within twelve months of becoming self-employed.

Pension provision without pension fund

Self-employed persons who do not join a pension fund can pay up to 20% of their self-employment income into pillar 3a per year, up to a maximum of CHF 34,416 per year (2021 and 2022). Pillar 3a solutions are offered by both insurance companies and banks. Especially in the case of pure savings solutions offered by banks, it is advisable to take out additional insurance to cover risks such as accident, illness, disability and death.

Pension provision with pension fund

Anyone who voluntarily opts for a pension fund solution (2nd pillar) covers risks via this route and does not need separate insurance. A connection can be made with the pension fund

of the professional association, the Stiftung Auffangeinrichtung BVG or a collective foundation. Self-employed persons who employ staff usually join the pension fund with which their employees are insured. Existing vested benefits must generally be transferred to the new pension fund.

The advantages of a pension fund solution outweigh the disadvantages, especially in the case of high incomes. According to the law, insured persons may pay in savings contributions of up to around 25% of their annual AHV salary.

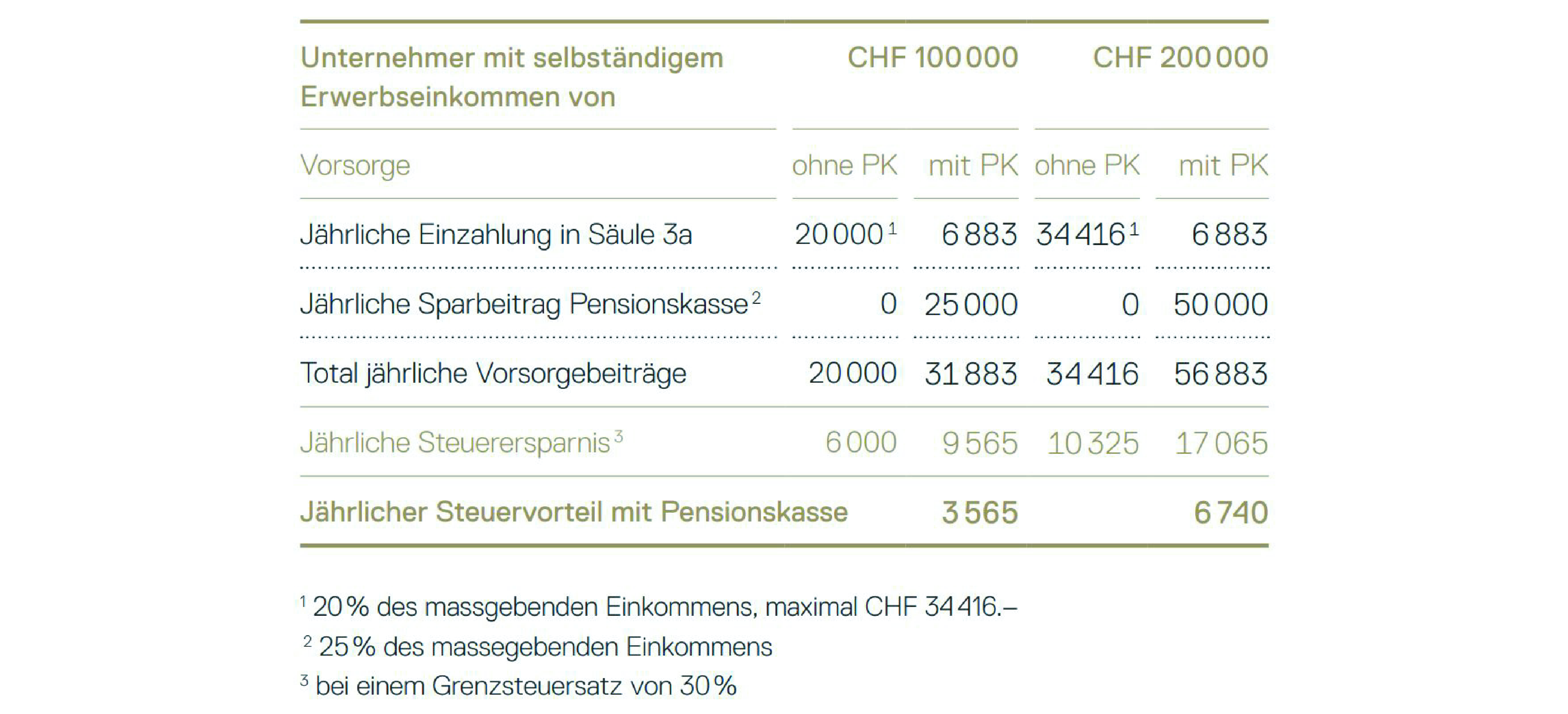

Additional private pension provision with pillar 3a is still possible, but a maximum of only CHF 6,883 per year (2021 and 2022) may be paid in. The following example illustrates this:

A self-employed person without a pension fund and an income of CHF 100,000 can pay a maximum of CHF 20,000 into pillar 3a, and with an income of CHF 200,000 a maximum of CHF 34,416. At a marginal tax rate of 30%, he thus saves around CHF 6,000 or CHF 10,300 in taxes.

With a pension fund solution with savings contributions of 25% and payment into the "small" pillar 3a, he pays around CHF 9,500 or CHF 17,000 less tax per year. He thus saves around CHF 3,500 or CHF 6,700 per year compared to a pension solution without a PF.

If there are gaps in coverage, the tax burden can be further reduced by voluntary purchases into the pension fund. In addition, half of the annual contributions (premiums and purchases) to the pension fund also reduce the income subject to AHV contributions and thus the AHV contributions.

If the choice of pension fund is open, offers from several collective foundations should be compared. There are often large differences in the costs of administration and the risk benefits in the event of disability and death - with identical death and disability benefits. This means that additional money can be saved by choosing the right collective foundation. In addition to premiums, factors such as interest on retirement assets, pension conversion rates, coverage ratio, guarantees and health checks should also be included in the provider comparison.

should be included in the provider comparison.

Conclusion

When starting a self-employed business, the existing capital is often drawn from the pension fund and invested in the own company. Because income is usually lower immediately after founding a start-up and little money is left over for savings, pension provision via the 3rd pillar is often an option in this phase.

However, considering one's own business as part of the pension solution in old age carries some risks. If the company has successfully established itself on the market, a pension solution with a pension fund is usually the obvious choice, and there is often a large savings potential.

This article has already been published in CORE-Newsletter 30 of December 2021.

Elmar Schafer

Vice-Director

VAT Specialist

Specialist in Finance and Accounting with a Federal Patent

T +41 26 492 78 52

es@core-partner.ch

AbaWeb

AbaWeb